You are an owner.

As an owner of this institution, when you succeed so do we! You should know how your investment at Alltru is affecting the community you live in. Every quarter, we report to our CDFI Advisory Board and Board of Directors on the impact of our work. We also want to share this news with you, our members!

There is still so much to be done and we encourage you to stay involved. Tell people what we’ve accomplished together and how their investment into an Alltru checking, savings or loan product has the power to impact their community.

Alltru is proud to be a CDFI.

What does CDFI mean?

Alltru Credit Union is a certified Community Development Financial Institution (CDFI), which means we are devoted to helping people achieve their financial goals by providing accessible financial tools to the St. Louis communities we serve. We approach this work in several different ways:

Partnership.

Many communities throughout St. Louis have been left without accessible bank or credit union branches. In an effort to build a presence in these divested communities, Alltru has partnered with local nonprofit organizations and programs to ensure financial stability is possible.

Kenneth & Stephanie

Financial Empowerment Coordinators

We are proud to partner with the Office of Financial Empowerment and Justine PETERSEN who open their doors for Alltru to serve their clients and work together to provide holistic financial capabilities programming. Our Financial Empowerment Coordinators work in their buildings to serve clients while they are receiving services.

174

Nonprofit Clients Added as New Members

203

Nonprofit Clients Given Free 1-on-1 Counseling

$384,871

Loans Deployed to Nonprofit Clients

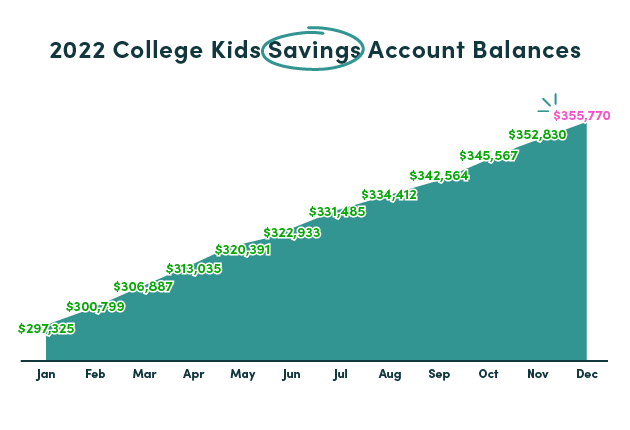

College Kids Program.

Since 2014, Alltru has opened over 23,000 savings accounts for incoming Kindergarteners in the City of St. Louis in partnership with the College Kids Program.

In 2022, College Kids families increased their college savings balances by nearly $60K to a total of $335,770, set aside only for college or trade school at the time of high school graduation.

This program is shifting the conversation of higher education all over the city of St. Louis. We are so proud to support this program and the families served by the College Kids office.

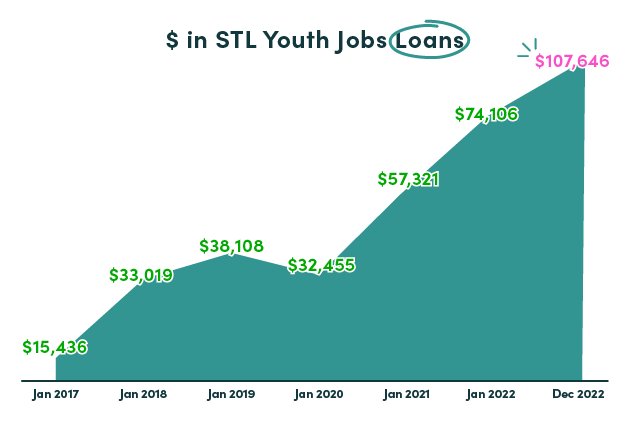

STL Youth Jobs.

Alltru serves youth in St. Louis under the age of 25 in job training programs with comprehensive financial literacy and access to free checking accounts with the STL Youth Jobs program. This program offers job training to youth through:

INDIVIDUALIZED CAREER ASSESSMENT

FINANCIAL LITERACY

EMPLOYMENT EXPERIENCE

Alltru makes sure that as they are receiving their first paychecks, they know how to manage their money for free.

In 2022, we celebrated $107,000 in loans deployed to STL Youth Jobs participants as they begin building their credit and borrowing funds for things they need.

Accessible Banking.

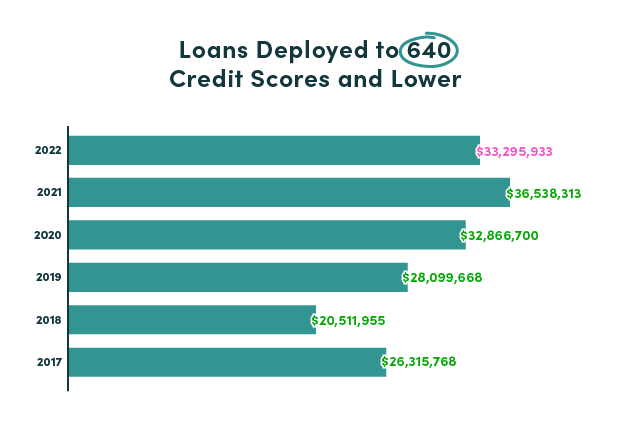

For generations, communities throughout St. Louis were intentionally denied access to important banking products. Checking accounts, home loans and small dollar loans have only been offered to low income or minority communities by way of predatory service providers for too long, leaving families in cycles of poverty not easily escaped.

We’re breaking this cycle by providing access. In 2022, Alltru deployed 6,500 savings, checking and loan products to families living in low income census tracts. We also deployed $33 million dollars in loans to individuals and families with credit scores below 640.

As a certified Community Development Financial Institution (CDFI), Alltru is focused on overcoming barriers of accessibility for every community and household in St. Louis City and St. Louis and St. Charles counties. Regardless of socio-economic status, people deserve a safe way to bank and borrow money. Alltru works hard to build bridges for financial stability for all.

Volunteering.

Each Alltru employee is given 8 hours of paid volunteer time so that we can make a difference in our communities by volunteering at local nonprofits. Although we give small dollar grants and service our partners with programming, we also want to be hands-on. And we want all of our employees to play a part in the success of the cooperative and their community.

This is all done, not because it’s highly profitable, but because it’s needed and it’s the right thing to do. It’s the right way to invest our time and energy.

Thank you for being an owner of Alltru Credit Union and for investing in real change for our communities.

Learn more about your membership and our shared community impact:

SHARE REPORT

Let’s Talk

We’re in your neighborhood.

We are St. Louis, through and through. We have branches throughout the metro area. Plus, as a member you’ll have free access to hundreds of local ATMs.