College is expensive, sometimes painfully so. Many students graduate carrying tens of thousands in student loan debt. In 2022–23, the average borrower earning a bachelor’s degree took out about $29,300 in student loans according to College Board Research.

In this guide, you’ll learn how to create a zero-based budget for this stage of life as well as learn tips on how to pay for these expenses. In this scenario, we will create a budget for a student who lives on campus. If you are a commuter student, adjust these categories to fit your situation.

With a zero-based budget, every dollar of your income and all of your expenses has a place in your budget. In the end, your income minus expenses will equal zero. You’re not actually spending all your money with this method; your savings simply get counted as part of your expenses. This method is ideal for college students because it helps you plan to meet your needs. In addition, you don’t have to worry about only spending a certain amount of money on needs versus wants and savings. At this stage in life, you have many expenses and often minimal income.

Getting Started

While your semester-to-semester expenses may shift, getting a solid baseline can prevent surprises.

According to a 2025 WalletHub survey, more than 86% of people report having a budget, but 74% say rising costs are their biggest barrier to sticking with it. WalletHub That’s especially true for students who face fluctuating costs like books, fees, and living expenses.

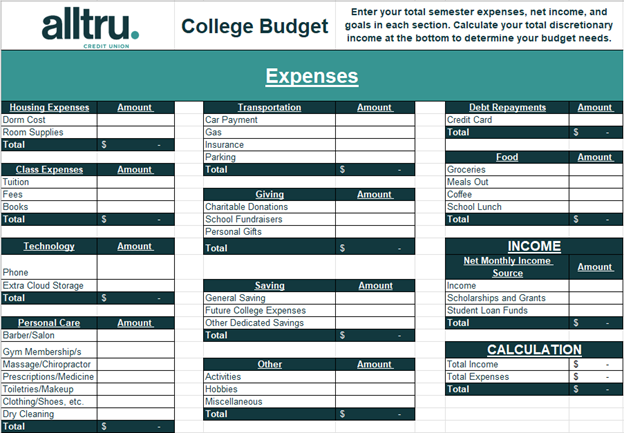

We’re going to use a budget template to help visualize and calculate. Follow these steps to fill in the template.

Step 1. Add your Housing Expenses and Class Expenses

As a college student, your student portal will have most of these numbers for you for a whole semester. Enter the semester totals in the spreadsheet. Estimate how much you will spend on Room Supplies for the entire semester.

Step 2. Add your Technology and Transportation Expenses

Since this budget is for an entire semester, the remaining totals need to equal how much you plan to spend during the semester, or around 4 months. For example, your phone payment in the Technology category costs $75 a month, multiply $75 by four to get your total, which is $300. Enter $300 in this section. Repeat this for your fixed expenses. Estimate your total for the expenses that may vary month-over-month.

Step 3. Add your Food, Debt Repayment, and Other Expenses

These categories may vary each month. Do your best to estimate how much you will spend on these categories. Be sure to put some money in the Miscellaneous category for unexpected or forgotten expenses that may come up. If this isn’t your first semester, look at your account history from your last semester to help guide you.

Step 4. Add your Giving and Saving

A well-rounded budget includes room for giving and saving for your future. The items in these sections are ideas for where you may give and save. By saving for your expenses ahead of time, you can help avoid unnecessary debt.

Step 5. Add your Income

Many college students work part-time jobs. Sometimes these funds go directly to tuition through work-study programs and sometimes they go directly to your paycheck. Whatever your situation, include your net income here. In addition, add this semester’s scholarships and grants. For the Student Loan Funds, add the amount available to you. At this point, this number should not be the real number you borrow. If you already had to agree to a certain amount, enter your real amount and keep in mind that this number can’t change later.

Step 6. Calculate

This spreadsheet will do the math for you. In the Calculation section, your Total Expense amount is subtracted from your Total Income.

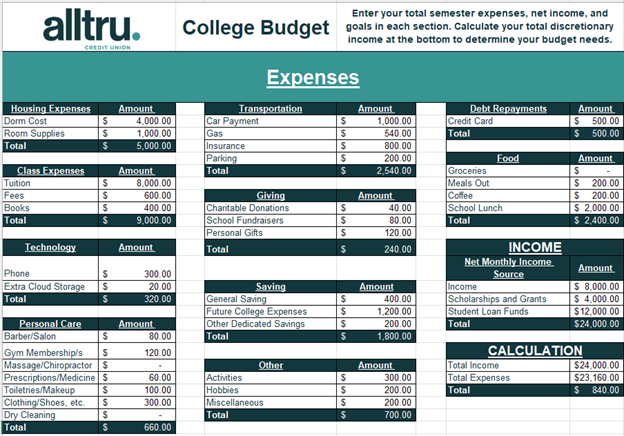

Here is an example.

Note the number in the Total section. It will either be positive, negative (in parentheses), or zero. For a zero-based budget, we need to get this total to zero.

Is Your Total Negative?

If your total is negative, this means that your expenses are bigger than your income. You have a few options to help make your total zero.

- Reduce your spending. Since you can’t reduce the costs of the fixed expenses, like your Tuition and Dorm Cost, you must reduce these expenses that you can adjust. Instead of budgeting $50 for hobbies each month, how about $40? Can you lower the cost of your toiletries or clothing? Reducing anything in your Saving section should be done with caution.

- Increase your income. Another way to adjust your total to zero is to increase your income. Can you work an extra 6 hours a week? At $13.75 an hour, that’s $82.50 a week of more income before taxes are subtracted.

- Reduce your spending AND increase your income. You can balance your total to zero by combining both options. Reduce some of your spending on categories that aren’t essential, such as Activities. Increase your income by working a few extra hours each month.

Is Your Total Positive?

If your total is positive, this is the best-case scenario. This means that your anticipated expenses are less than your anticipated income. We need to balance your budget to total zero. Here are a few ways how.

- Decrease your student loan total. At this point in your budgeting journey, the amount of money in your Student Loan section is how much you can borrow, not how much you are going to borrow. If you are comfortable with the other sections of your budget, reduce the amount of money you borrow this semester.

- Pay off other debt faster. If you have other debt besides your student loans that you pay for each month, paying off this debt faster may be the better option. Many organizations who offer student loans don’t ask the borrower to start making payments until after they graduate. Credit card companies and Auto Loan lenders aren’t this generous. Use your extra money to pay for more than the minimum.

- Save more. If you are comfortable with the other categories in your budget, save your extra money instead. This can go to your general savings or to a dedicated amount to help you reach your goal faster.

- Have some fun. Budgeting is helpful for keeping your spending in check. If your total is positive, this means you are doing it well. This allows you to be a little lenient and spend more on nonessentials like activities, hobbies, and coffee runs.

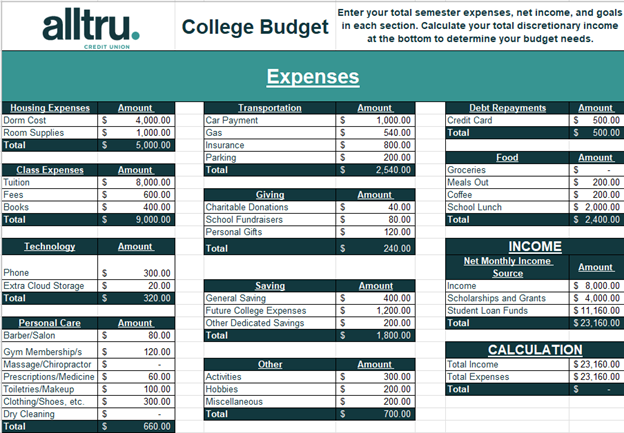

In this example, I reduced how much I plan to borrow through student loans. You can see that my total now equals zero because my Total Income and Total Expenses are the same. This means my budget is ready for me to put into action.

We’re Here for You

We are here for every step of your journey. Now that you have your college budget in place, make sure you have the necessary accounts. Open a Checking and Savings account to store your income, pay your bills, and save for your future expenses. If you want to build credit in the process, our Rewards Visa can help establish strong credit and provide bonus perks too. Happy budgeting