Purchasing a new or new-to-you car can be exciting. Financing that car is usually dreaded. If you’re new to the car shopping experience, we are here to walk you through the steps needed to get an auto loan.

It will be easier to secure an auto loan if you know exactly what vehicle you want to purchase. If you aren’t positive yet, you can still start the process and adjust the details as you go.

Start with the Money You Have

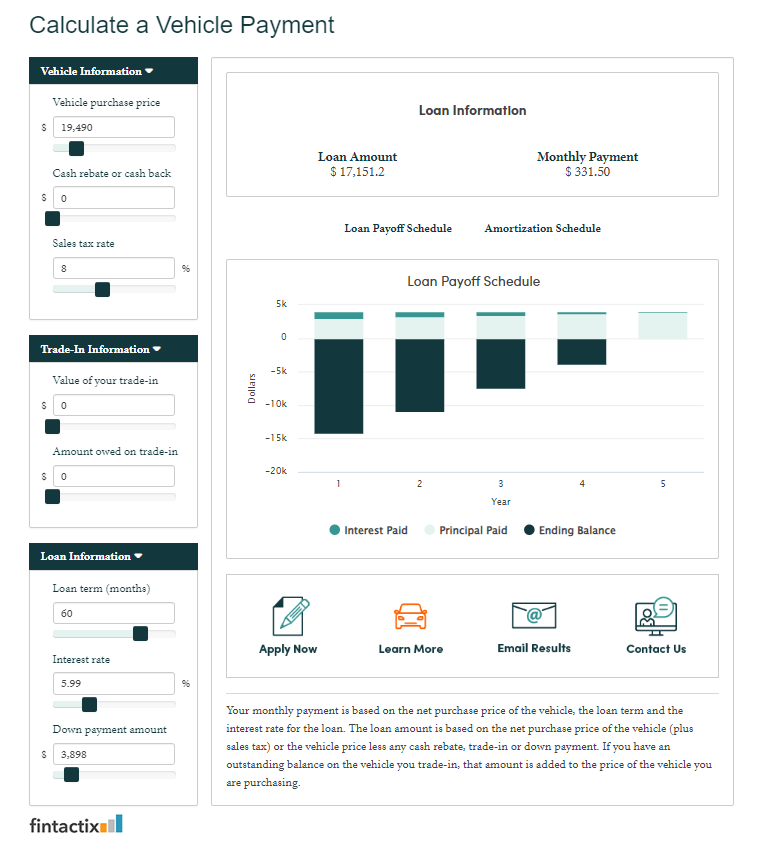

Assuming you know what car you want to purchase, visit our Calculate a Vehicle Payment Calculator. Starting on the top left of the page in the Vehicle Information section, enter in your desired vehicle price. Use the MSRP in this step. This can be found on the dealership’s website or on the window sticker of the car. If you will be buying the car during a rebate or cash back opportunity with the dealer, enter this number in the next slot. Finally, enter the sales tax rate for the vehicle.

If you are trading in a car for profit or will owe money when you trade in a car, enter this amount in the Trade-In Information section. If you aren’t trading in a car when you go to purchase a new vehicle, set these amounts to $0.

Evaluate Potential Loan Information

Finally, enter your desired loan term in months in the Loan Information section. Enter the interest rate for your loan term and the amount of money you are applying as a down payment. With an Auto Loan from Alltru, you can find your APR on our website or by talking to our staff at a branch.

Calculate Your Monthly Payment

Take a look at the loan information on the top right of the page. Will this monthly payment work with your budget? If so, keep going! If this monthly payment looks too high, consider a longer loan term or purchasing a car that costs less so you can decrease your monthly payment.

Apply for a Loan

Next, submit your application to Alltru online or by stopping by a branch. If you aren’t all Alltru member yet, we can quickly determine if you are eligible to join. When you submit your application, you’ll enter some basic information about your finances and the car you want to buy. We will have to do a hard credit pull, which may decrease your credit score by a few points.

Generally, the higher your credit, the lower your Annual Percentage Rate or APR. If you have low or poor credit, consider adding a cosigner. This does make your cosigner contractually responsible for the car loan too, but the payments should come from you. If you fail to make your payments on time, this can lower your and your cosigner’s credit scores.

Get Preapproved

Within a business day, we will preapprove your application and notify you when your preapproval is complete.

Now, it’s time for you to go to the dealership. After you test drive a few cars and determine which one you want to buy, you’ll negotiate the price with a salesperson. Use your preapproval from Alltru as leverage to talk down the price. At this point, you need to be ready to make your down payment, so make sure your funds are in an accessible account.

Finalize the Deal

Once you seal the deal on your new car, send us the purchase agreement so we can finalize your loan documents online. Depending on the agreements in your loan, we’ll send the funds to you or the dealer.

That’s it! When you find the car you want to purchase, get your auto loan from Alltru for an easy and fast approval process. You’re ready to begin car shopping!