Rent and home prices are reaching record highs, making affordable housing a challenge for many of us. One way to ensure financial stability is by setting a healthy monthly budget for housing expenses. While the general rule of thumb suggests allocating no more than 30% of your gross monthly income to housing, this ratio can serve as a helpful guideline rather than a strict rule. In this blog, we’ll explore practical tips for maintaining a healthy housing budget amidst rising costs.

Assess Your Budget

Due to increasing inflation, it’s important to regularly evaluate your monthly income against your current expenses. Consider how your financial situation has changed and create a realistic plan for managing your income. Establish a budget that includes essential expenses like groceries, gas, healthcare, childcare, savings, and entertainment. Even a simple budget can help you track your expenses and make necessary adjustments. Since a mortgage is a long-term debt repayment, using the zero-based budgeting method makes sense if you want to get serious about saving for a house while managing your other life expenses.

Tackle Debt

High credit card balances or other debts can make it difficult to manage housing costs. Start by paying off your highest-interest debt first, gradually working your way down to lower-interest debts. This strategy allows you to save more money in the long run. If debt becomes overwhelming, explore options such as debt management plans or a debt consolidation loan. These resources can help you reduce monthly payments and minimize overall debt costs.

When you apply for a mortgage, the lender will evaluate your debt-to-income ratio, or DTI ratio. This compares your minimum monthly debt payments versus your income to evaluate how risky it is for them to lend you a mortgage. The lower your DTI ratio, the more likely you are to be approved for a mortgage with a low rate.

Identify Areas to Cut Costs

To maintain a healthy housing budget, it’s crucial to identify areas where you can cut costs. Simple measures such as meal planning can help reduce grocery bills, canceling unused streaming services, and cutting back on energy usage can lower expenses further. Additionally, consider options for reducing interest rates or monthly payments on your debts. By postponing major purchases and setting aside cash for future expenses, you can minimize reliance on credit when the time comes to make those purchases.

These small steps can make a difference over time if you are consistent. If you only cut costs for a few months and go back to your old habits, it won’t matter in the grand scheme of saving for a house with manageable monthly payments. Your budget can help you stay on track with cutting your spending.

Seek Guidance from a Financial Counselor

Whether you’re facing short-term budget challenges or long-term financial difficulties, a financial counselor can provide valuable support. They can help you develop a personalized plan to navigate your financial situation effectively. If you don’t have access to a financial counselor, we’d be happy to help you develop a plan to help you stay on track. Many of our employees are Certified Credit Union Financial Counselors. By offering personalized financial strategies, these counselors help members improve their financial literacy, manage their loan balances, and achieve their financial goals.

Put It in Action

To put this plan into action, create a budget. Calculate how much of your income you spend on your housing expenses each month. This should include insurance, utilities, and HOA fees too. Your budget should include a plan to pay off your debt so you can start saving more for a down payment in the future.

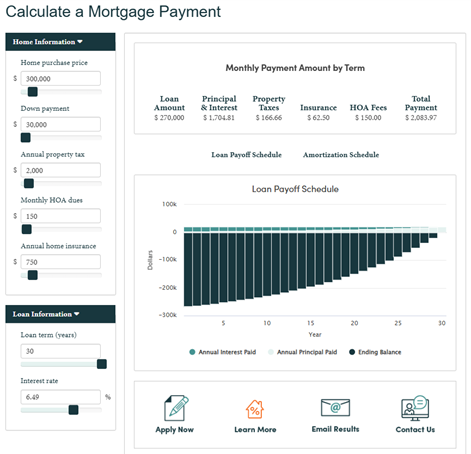

Next, use our mortgage payment calculator and play with the numbers. For example, Chris has an annual salary of $75,000, which is $6,250 a month. He calculated that 30% of his monthly gross income totals $1,875. Currently, his rent and other housing expenses total $1,525, which means if his new house expenses are closer to $1,875, he’ll need to adjust his zero-based budget.

With Chris’s current savings, desired home purchase price, and estimated fees, these total monthly payments are almost $2,100. This is well above the 30% guideline which isn’t sustainable in the long run. His options are to opt for a cheaper home or save more toward his down payment.

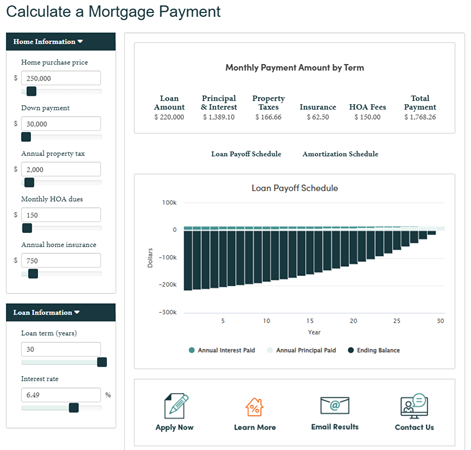

Chris would rather buy a home sooner instead of saving for a larger down payment. He decided to reevaluate his housing priorities and found several houses that cost around $250,000. By rerunning the numbers, he determined that this decrease in housing costs is affordable and sustainable.

As rent and home prices continue to rise, maintaining an affordable housing budget is vital for financial well-being. By adhering to the 30% guideline for housing expenses, regularly assessing your budget, managing debt strategically, reducing expenses, and seeking guidance when needed, you can maintain a stable financial foundation. Take control of your housing budget today and secure a brighter financial future.