Debt is miserable. Unfortunately, debt is also, oftentimes, completely necessary. It’s almost impossible to start a career without a college education, reliable transportation and resources like a professional wardrobe and functional computer with internet access. All of that costs a lot of dough. Before you can get your footing in a solid career and established income, you’ve become buried in student loans, auto payments and credit card debt. That is where a snowball budget can help.

I couldn’t believe after finishing my MBA, how high my monthly student loan payments would be. That wasn’t including the two cars my husband and I had to buy that same year, and the credit card debt he brought into the marriage. Add rent, groceries, internet, insurance, taxes, and what feels like a never-ending cycle of mother’s day, nieces birthdays and Christmas holidays… Moneying when you are young is hard.

All that to say, a few years into this horrible cycle of always having more month than we did money, we learned a new trick called Snowballing.

It works like this…

1.Make a list of all of your debt. Not monthly expenses. Just your loans. Auto loans, student loans, mortgage loans, credit card loans, etc.

2. Now put them in order of smallest balance to largest. For us, the smallest balance was on one of my student loans.

3. If you can, pay off that balance in full. So for us, the balance was $800, and we used a tax refund that year to wipe it out. If you can’t pay it off in full immediately, make a plan to start paying a little extra on that balance and pay it off as soon as possible.

4. Once that balance is paid off, you take the payment you were making on that loan balance, and add it to the monthly payment of the next largest balance until IT is paid off in full. Then you take the full payment you were making on those first two loans and add it to the monthly payment on the next loan.

5. BAM! You are on your way to being debt free.

A couple of notes. Some people choose to start by paying off the loans with the highest interest first. I’m just a gal who needs to see results fast, so I started with the lowest balance. I could pay it off in one final swoop and I felt like a champ.

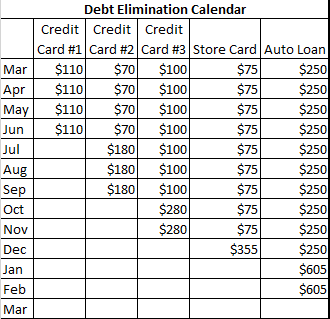

Another good idea is to map out how long it will take to be totally debt free. We recently used an excel sheet and mapped out how many payments we had for each loan and the balance for each and figured out we could pay off the whole thing in 8 years, including our mortgage. Debt free in ‘25 BABY!

I won’t show you my exact map for my snowball budget, because I’m secretive like that, but here is an example of what that might look like.

You don’t need to be a math wizard or an Excel spreadsheet nerd. Get your credit report(s) together and make a plan on paper. Write it down and set reminders on your phone for when to start making bigger payments on a loan as they pay off. Tell your mom or best friend or gloat about it on Facebook. Make sure you are being held accountable to do this. Also, consider setting your payments to come out automatically so you aren’t tempted to skimp on your snowballed payments. You can use Bill Pay in your Alltru online banking account to set that up.

Do whatever works for you. Just let that snowballed payment get bigger and bigger and Bigger and BIGGER. It’ll move faster than you think with a snowball budget.

Until next time.

Live long and prosper,

Laura Woods