Yay, you did it! Congratulations! So, what’s next? Do you have a job lined up? Or is college or the military your next chapter? Either way, making sure you are prepared to make smart money decisions is important as you take that next step in life. Here are a few money tips to help our high school graduates get started.

1) Learn how to create a budget.

The essence of solid financial planning is budgeting. You’ve probably heard this before, but that’s because it’s so important. Understanding your essential expenses like rent, utilities, and food versus the amount of income you expect to make is very important. Learn how to create a budget.

2) Work on your credit score.

Having a good credit score is central to living the life you want. Making on-time payments for your car loan, phone bills, and rent will help you establish a good credit score. You can also build your credit score by, wisely, using a credit card. Make your payments on time and keep your credit utilization under 30% on your credit card (meaning if your credit limit is $1,000 you charge less than $300 or 30% of the total line of credit) and you’ll help build your credit.

3) Make saving automatic.

Automating savings can help you save for a big purchase or create an emergency fund. You can set up regular deposits or transfers into your savings account so you can save money before spending it. For example, instead of waiting to put money into your savings until after you pay your bills every month, automatic transfers allow you to save money first. There are two ways to do this:

- Use direct deposit to help you save. Most direct deposit programs allow you to split your paycheck so a portion goes directly into your savings account.

- Schedule automatic transfers. These let you regularly transfer money to your savings account from another eligible account such as your checking account. Our Rollup Savings account makes it easy to save without even thinking about it.

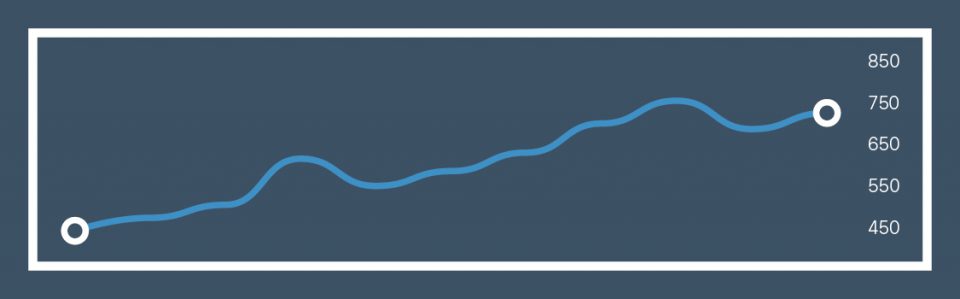

You can adjust your transfers or deposits any time you want, but if you stay the course, you could see big rewards over time. For example, if you save $30 a week, in one year you would have more than $1,500 saved, which could be enough for a down payment on a car, an appliance, or a vacation.

Tip: Make sure to schedule your transfers when you know you have enough money in your account, such as after each payday. And find a savings account with a higher than average yield so that you make the most from your money.

4) Start saving today for your future.

It’s easy to understand why saving for retirement doesn’t seem like a priority right now, building and advancing your career seems more important. But your youth is a huge advantage when it comes to building wealth for retirement because it gives you time to maximize the power of compound interest. Funding a 401(k) might seem impossible if you’re struggling to pay the rent, but letting expenses become an excuse is a mistake. Try to save at least 10% of your income in your 401(k). Plus, if you’re eligible for 401(k) at work, most employers will match your contribution so it’s free money. If you aren’t eligible for a retirement fund at work, sign up for a Roth IRA.

We’re so proud of all the high school graduates and we wish you the best of luck in your future endeavors! Take advantage of your youth and start down the right financial path early. If you have any questions, please don’t hesitate to reach out to Alltru. We are happy to help you on your journey!

Chelsea Springli