Seeing your paycheck hit your account on payday can feel like a relief, especially when you’re trying to pay off debt. But if you start spending as soon as you get paid, you might regret it later when more bills are due or your credit card balance goes up instead of down. Paying off debt means being smart about what you do on payday, and even before you get paid.

What do you do on payday if you have debt? Let’s walk through taking control of your paycheck and using it to climb out of debt.

Pre-Payday: Create a Plan

Before payday comes, you want to have a plan in place so you can pay all your bills and expenses on time. After all, missing payment is one way debt can keep piling up. While paying off debt does take time, it becomes easier when you have realistic and effective steps to follow.

The first step is to create a budget. While there are many was ways to budget, most of them have one thing in common: pay for the mandatory expenses first and everything else comes second. To start, write down your monthly payments and survival needs like your mortgage, car payments, insurance costs, groceries, electric bill, etc. Then, add your minimum monthly payment costs for your loans. Be sure to add all of them. After that, include other expenses such as household supplies, clothing, and gas. Don’t forget to add savings (so you’re setting up future you for success) and a fun money section (so you don’t go crazy in the process.) I recommend using a spreadsheet so it will automatically do the math for you.

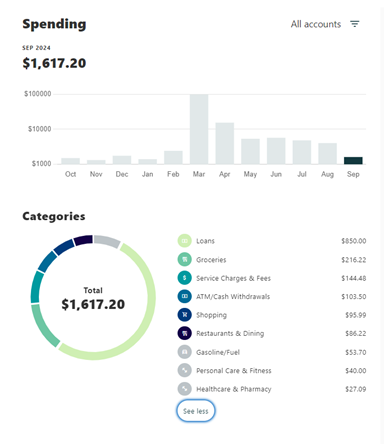

If creating a budget seems too hard, you can get a quick snapshot of your current spending by logging into Digital Banking, going to Tools & Settings, and clicking on Financial Wellness.

Pre-Payday: Organize Your Expenses

Next, organize the bills by when they are due. You might pay for groceries every four days but pay for your mortgage on the 20th of each month. In this scenario, you could go grocery shopping on September 1st, 5th, 9th, 13th, 17th, 21st, 24th, 27th, and 30th. Here, you would slot in 5 grocery runs before you make your mortgage payment.

Once all your expenses are in chronological order, add in when your paydays. Many people get paid twice a month or every other Friday. A consistent payday makes this process easier, but it is possible with a fluctuating payday. If you have a job where you get paid every day, such as a waiter or dog groomer, try to estimate your weekly pay.

After all your expenses are covered and your paydays are added in, see if you have any money left. If you don’t have enough to cover everything, adjust the parts of your budget that fluctuate, like groceries, savings, or fun money.

It might be possible to adjust the due dates for your bills each month. Talk to your providers to see if they can change the due dates to better fit your budget.

If you have your expenses covered and you have some extra funds, great! Increase your monthly payments toward your loans so you are paying more than your minimum monthly payment. This money will come off the principal of the loan and not off the interest. This means that you will pay off your debt faster!

Payday: Take Action

Now that your budget is in place, you will know what all your money should be going toward. When payday comes, you’ll know what expenses, including payments toward debt, you must pay before your next paycheck. Stay disciplined and follow your budget to the best of your ability.

With Alltru’s online and mobile banking, you can create separate accounts. Open accounts to cover groceries, car payments, and other payments. When you receive your paycheck, move the appropriate amount of money into these accounts. When those bills are due, you have money set aside to pay the amount in full.

While budgeting like this can be exhausting, it gets easier the longer you stick to it. Managing your debt and expenses paycheck to paycheck for a while can eventually get you back on top and set you up for success in the future.