Life’s curveballs aren’t cheap. Whether you get a flat tire, your dog needs an emergency vet visit, or you are just having a hard time making it to the end of the month, there are times when you need cash fast. In an ideal world, you’d swipe your debit card or, in a pinch, your credit card. But if you have bad credit and no savings, a payday loan may seem like your only option.

What is a payday loan?

A payday loan is a very short-term loan, generally, $500 or less, that’s due in a couple of weeks (usually a pay cycle). Payday loans are also known as cash advance loans, post-dated check loans, check advance loans, or deferred deposit loans. Payday loans work best for people who need cash in a hurry. They are advertised as a quick and easy solution to a temporary cash-flow problem, but in reality, a payday loan rarely ends up being easy OR temporary! Keep reading to find out why.

Why are payday loans bad?

From surface-level, payday loans may not seem all that bad. You have an emergency where you need money and payday lenders offer you a quick solution to fix your cash flow problem. But according to the Consumer Financial Protection Bureau (CFPB), fees are typically $15 per $100, meaning a $300 loan demands a $45 fee — equivalent to an annual percentage rate (APR) of 400%. And $15 is just on average!

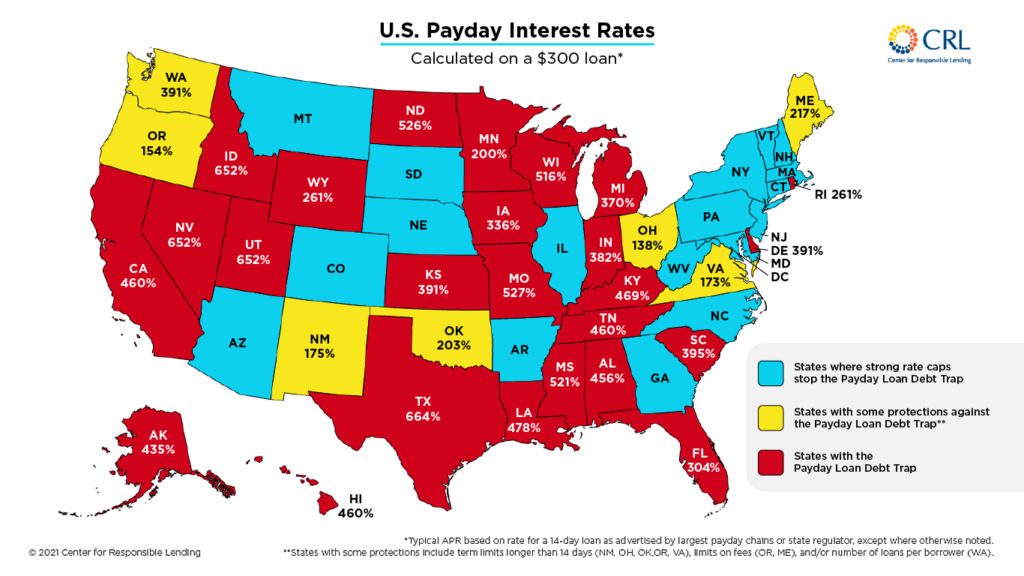

As you can see on the map below, the Center for Responsible Lending listed Missouri as a “Payday Loan Debt Trap” with payday lenders charging an average of 527% interest! Compare that interest rate with credit cards, which currently have an average APR of about 23% and you can see why payday loans are so bad.

But that’s not all, when you sign up for a payday loan, you give the lender access to your checking account so they can deduct what they’re owed (plus a fee) on payday — or you have to write them a post-dated check. That’s how they know you’re good for the money. Payday lenders don’t actually care whether you can pay your bills or not. So when payday comes, they get their money, and you can only hope that you’ll have enough left to get you through the end of the month.

The vicious circle of a payday loan.

When you take out a payday loan you’ll often get locked into an ongoing cycle. One payday loan creates the need for a second, which then creates the need for a third, and so on. The problem is that the borrower usually needs to take another payday loan to pay off the first one. The whole reason for taking the first payday loan is because you didn’t have the money for an emergency need. Since regular earnings will be consumed by regular expenses, you won’t be any better off in two weeks and the cycle will go on and on.

Alternatives to payday loans.

The good news is there are alternatives to payday loans that won’t lock you into a never-ending cycle of debt. Here are a few of our recommendations:

- Contact your creditors if you are having problems making your payments and ask for more time or try to negotiate a payment plan with them.

- Alltru Credit Union members have access to free and confidential credit counseling services that offer budget and credit counseling, and credit report review.

- Apply for a personal loan at the credit union.

- Get a cash advance from your credit card; the interest you pay will be substantially less than a payday loan.

- Use your Courtesy Pay feature.

- Sell a personal item to make some extra cash.

- Ask a relative or friend to lend you money and work out a payment plan.

How to avoid needing a payday loan.

The two most basic reasons why people fall into the payday loan trap are bad credit and a lack of savings. It’s not easy to overcome either problem, let alone both. But since payday loans trap you into a cycle that’s almost impossible to get out of, it’s worth making the effort.

Step 1: Stop borrowing money

One way to course-correct your financial wellbeing is to stop taking out loans that could catapult you into a deeper level of debt. We know, however, that this is easier said than done. Luckily there is an exception to that rule, and that’s an Alltru Credit Builder Loan. This loan was designed specifically for people with either no credit or bad credit to help build their credit scores.

Here’s how it works:

- The money you borrow through the Credit Builder Loan will be held as collateral.

- As you pay off your loan, we will report your good payment history to the major credit bureaus.

- As you build good credit, it will help to offset your history of bad credit. This will increase your credit score quicker than simply paying off bad debt.

- Once your loan is paid off, the money from the loan will be fully released back to you.

You’ll have saved a nice chunk of money, and you’ll have improved your credit score! Plus, when you make all loan payments on time, we will refund half of the interest paid right back to you. It’s a great first step to a bright financial future!

Step 2: Start saving money

The best way to eliminate the need for payday loans is to become financially self-sufficient, and the only way to do that is by having cash in the bank. Once you’ve accrued a decent amount, you’ll then be able to use savings when an emergency hits, rather than turning to high-priced lenders.

But how do you build up savings if you’ve never had much in the past?

It will take time and discipline to increase your income and decrease your spending. When you’re in a jam, it’s completely understandable to consider a payday loan. Just remember that fast, easy money comes at a high cost that you may be able to avoid by seeking other options. Don’t get stuck in a debt trap. Instead, let us help you build healthy financial habits for a stress-free life.

Until next time,

Chelsea Springli