Hey Alltru family! We’ve got some exciting news about a new financial tool that will make managing your money a breeze and take your financial game to the next level. Meet the Financial Health Survey—a personalized guide designed to help you understand and improve your financial situation. Whether you’re already an Alltru member or just looking to up your financial game, let’s explore this cutting-edge survey. But first, let’s learn more about the steps toward your financial growth.

3 Steps To Financial Maturity

We all know how important it is to have a healthy relationship with our finances, but have you ever stopped to think about what financial wealth means to you? And more importantly, how can it shape your future?

Let’s start by simplifying financial maturity down to 3 simple ideas:

- Defining Financial Maturity – By creating a self-defined statement of what financial maturity looks like for your life, you can clearly envision the end goal you seek to reach.

- Awareness of Financial Position & Obstacles – Now that your end goal has been defined, it’s critical that you understand your current position and the various obstacles keeping you from reaching your desired vision. Without awareness of your financial story, it’s difficult to understand the steps you should be taking to make progressive change.

- Creating a Plan & Sticking With It Daily – As the statement suggests, you need to create a practical plan that you can start implementing right away. One method that has been helpful for me is to establish S.M.A.R.T. goals and include 4-5 milestone goals that support them. This way, I can ensure that I am progressing towards achieving my ultimate objective.

Now, let me show you how the Financial Health Survey will help you understand your financial story while providing tips and resources to build an effective financial plan to reach your goals.

How The Financial Health Survey Works

Here’s how you can access this powerful tool in a few simple steps:

- Log in to online banking or the mobile banking app.

- In online banking, select “Financial Planning.”

- In the mobile app, tap “More,” then “Financial Planning,” and finally “Financial Wellness.”

- In the Financial Wellness section, choose “Financial Health.”

- Click on “Start Here” to kick off the assessment.

Think of this tool as your friendly GPS for your financial well-being. It breaks down your financial life into four key segments—spending, saving, borrowing, and planning. Eight thoughtfully crafted questions make it a simple yet powerful way to shape your financial narrative.

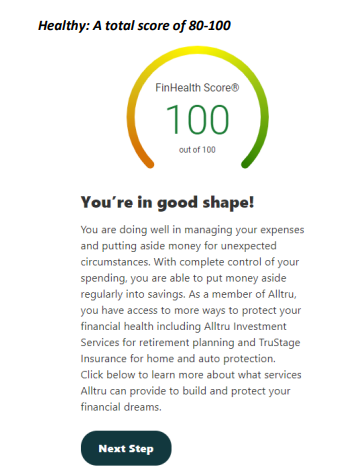

Understanding Your Financial Health Score

Ever thought of your financial journey as a novel with different chapters? Your Financial Health Score is the decoder ring to your financial story. As you explore the spending, saving, borrowing, and planning segments, you’re peeling back the layers of your unique financial tale. It’s about being self-aware, not judgmental.

Pairing Your Insights with Alltru

Once you’ve finished the assessment, reach out for guidance and support. Connect with one of our Member Experience Specialists to discuss your findings and create a plan of action. Don’t just collect information—take action! Our team is here to guide you through understanding your financial score and help you make the best choices for your financial well-being.

Psst! If you prefer staying in, no worries! Our video banking services let you handle your finances from the comfort of your home.

In Conclusion

Picture life as a symphony and your finances as the music. The Financial Health Survey guides the financial notes, creating a melodic tone for your financial journey. It’s not just about planning; it’s about taking action. Use the insights gained, shape your financial story, and let the Financial Health Survey be your guiding force. Our friendly team is here for you. Book an appointment, and let’s work together to create a future where you control your finances.