If you are preparing to attend college, chances are one of your biggest concerns is how you will pay for your higher education.

Rest assured, you aren’t alone in this journey. Thankfully, there’s several options to help pay for college, and many families rely on a combination of financial resources to fulfill their education expenses. Some students save money leading up to college to help with tuition and fees using a savings account or Coverdell Education IRA, but with the average cost for most colleges and universities around $30,000 per year, it’s unlikely to foot the bill without assistance. Generally, most students must rely on some sort of financial help either from scholarships, loans or grants.

In this article, we will cover all of the bases so that you can make a game plan for funding college and go get that degree!

Financial Aid

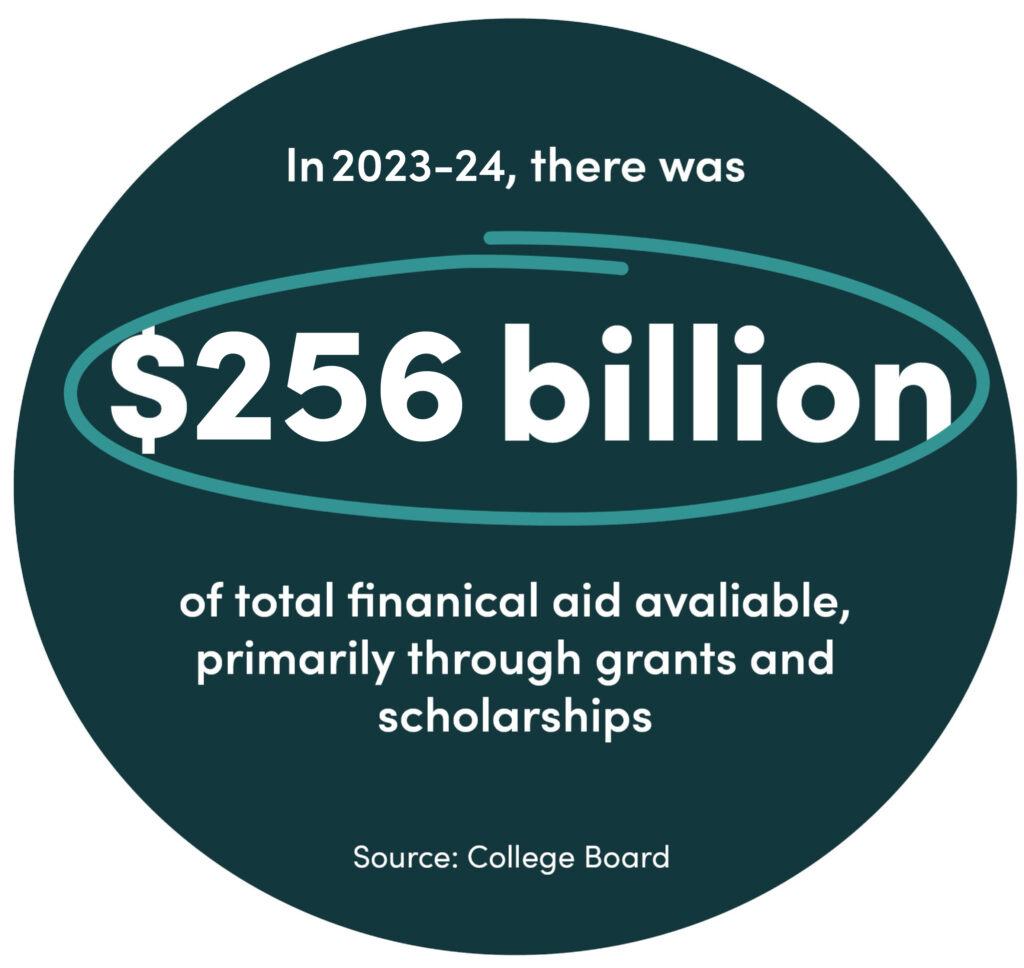

The first step is to apply for Financial Aid. Ranging from grants to scholarships to work studies and loans, Financial Aid allows for many students and families across the nation to afford college since it reduces their out-of-pocket costs. Eligible individuals receive funding to cover educational expenses including tuition and fees, room and board, books, and transportation.

Here are some commonly answered questions on Financial Aid to help you get started:

How do I apply for federal financial aid and grants? Financial Aid can save you a significant amount of tuition money. Even if you don’t think you’ll receive benefits, you should still apply (you never know). The FAFSA, officially known as the Free Application for Federal Student Aid, is the annual form that families fill out to apply for federal grants, loans, and work-study programs for college students. It is administered by the U.S. Department of Education and opens every year on October 1.

Does my family earn too much to be eligible for help? Need-based aid isn’t the only financial aid available. If your family’s income is higher than the maximum threshold, you may not qualify for certain aid programs — namely, federal grants. But if you want to be considered for other aid, including work-study programs and federal student loans, you still need to complete the FAFSA. Also, the FAFSA is often needed in order to qualify for merit scholarships for grades, SAT scores or athletics.

Do I need to apply for financial aid more than once? Yes, you have to submit the FAFSA every year. Filling out the FAFSA isn’t a one-time-only event. You need to do it every year if you want to be considered for financial aid.

What if I don’t qualify for federal financial aid? If you don’t qualify for financial aid, that’s okay! Don’t lose hope as there are many other options available including taking out a student loan to help pay for college.

Scholarships

After applying for Financial Aid, we encourage you to seek out scholarships at your particular college or university. Do research on the schools you plan on applying to and see what scholarship opportunities they offer. Be aware that you will have to meet certain requirements in order to be eligible for scholarships. We encourage you to apply for these as early as possible because most of the time you’ll need to write a supplemental essay during the application process – which might take some time. It’s never a good idea to wait until the last minute to apply in case you end up missing the deadline.

PRO TIP!

Some applications will time out if you spend too long on them. To avoid this, prepare your personal statement and/or essays ahead of time in a word document or PDF and then copy and paste them into the scholarship application.

Many award scholarships on a variety of criteria including academic achievement, leadership, field of study, and/or financial need. Start exploring and see what scholarship opportunities are out there. The best part about scholarships is that you do not have to repay the funds.

Loans

Along with federal loans, student loans are also available as a financial aid to college students. These loans will help close any gaps between your built-up savings and the cost of tuition. It’s important to understand that you borrow the funds in student loans and must repay them with interest. At Alltru, we offer loans with low interest rates and flexible terms up to 24 months, or 2 years. Make sure to find a loan that aligns with your budget so that you can realistically pay it off within its set terms. We encourage you to get out there and explore your options to find the right loan for you. Use our free loan payment calculator and enter your loan amount to find the right terms for you.

The ideal way to pay for college is to start saving now as early as you can, as it will benefit you later. It’s never too late to begin saving for college. By taking a look at your income and time frame, you should have a better understanding of how much aid you’ll likely receive to offset the cost of your education. Once you have your goal, use our Savings Calculator or Set a Savings Goal to set aside funds each month to reach your college savings goal. To go the extra mile, learn how to build a budget and practice healthy financial habits and you’ll be off to college in no time!