When it comes to saving and budgeting, it can get complicated very fast. You can conveniently set, track, and manage your financial goals online with our savings goal tool.

Accessible through online banking, savings goals allow you to save up for life’s most important events without the added financial stress. Become the boss of your finances by allocating funds for your personalized financial goals. Multiple goals can be setup per account – let’s say you are saving up for a car and for an upcoming vacation. No problem! Whatever your goals may be, we have the tools to support you in your financial journey.

In this article, we will go over how to set up a savings goal online as well as how to add funds to your goal. Although goals need to be set up online, you can manage and track their progress on the Alltru CU app.

To set up a savings goal:

Step 1: Log into your online banking account.

Step 2: Once in the dashboard, select Financial Planning from the menu at the top.

Step 3: Select the Savings Goals tab under the Financial Wellness section.

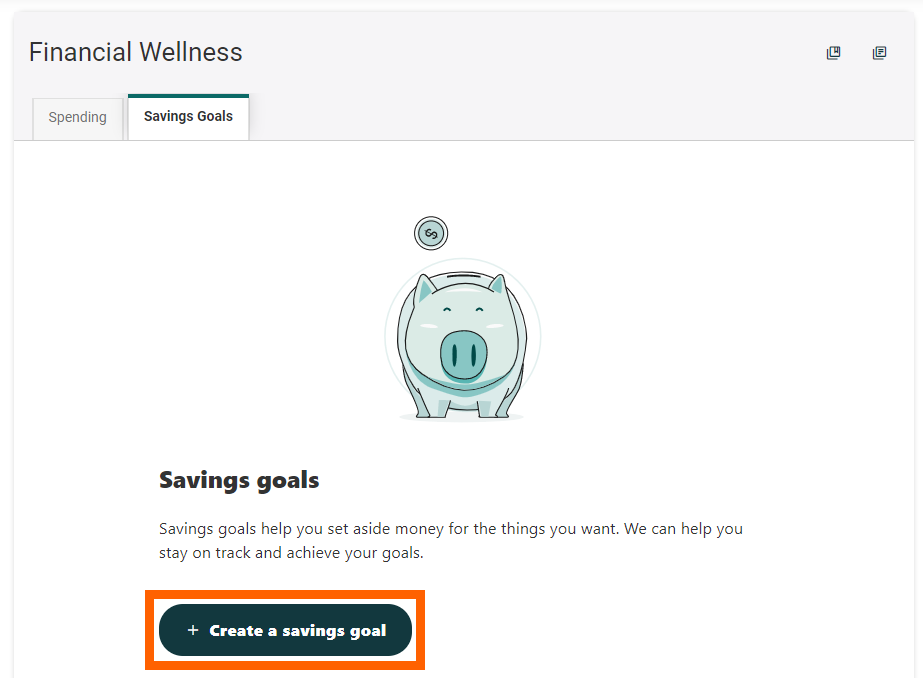

Step 4: Click the green Create a savings goal button.

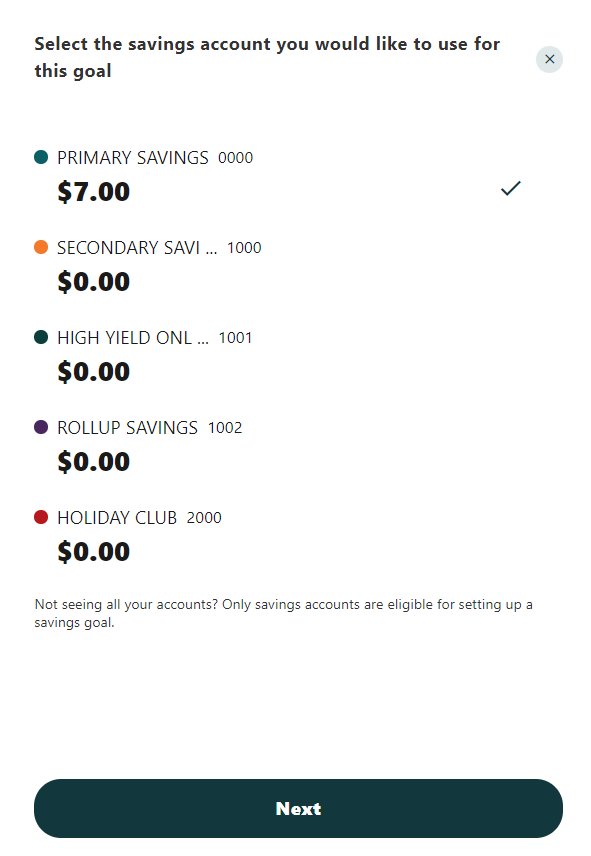

Step 5: Select the savings account you would like to use for this goal. If you have more than one savings account they will all be listed here for you to choose from. Then, click the green Next button at the bottom of the screen.

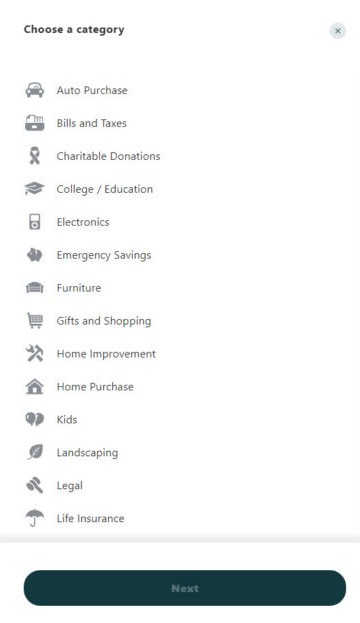

Step 6: Choose a category from the list for your savings goal and select the green Next button at the bottom of the screen.

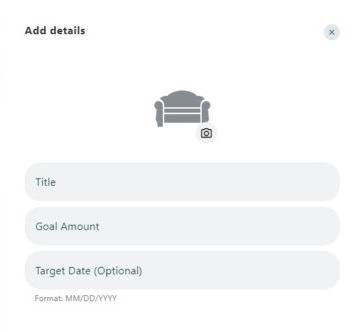

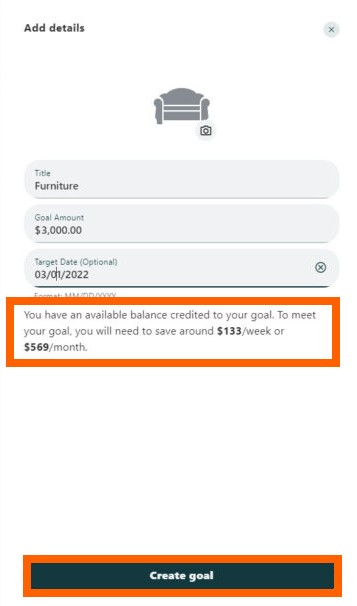

Step 7: Add details to your savings goal.

- Begin by Naming the goal.

- Next, enter the amount of money you’ll need to save in order to reach your goal in Goal Amount.

- In Target Date, enter the end date that you wish to complete your goal (optional).

Based on the target date, the system will generate the average amount needed monthly to reach your specific goal. Finally, select the Create Goal button at the bottom of the screen.

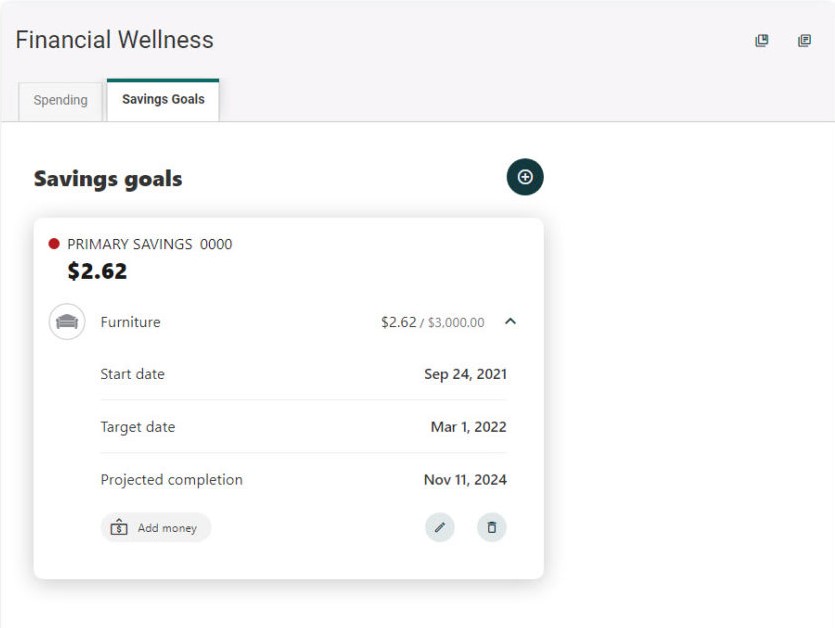

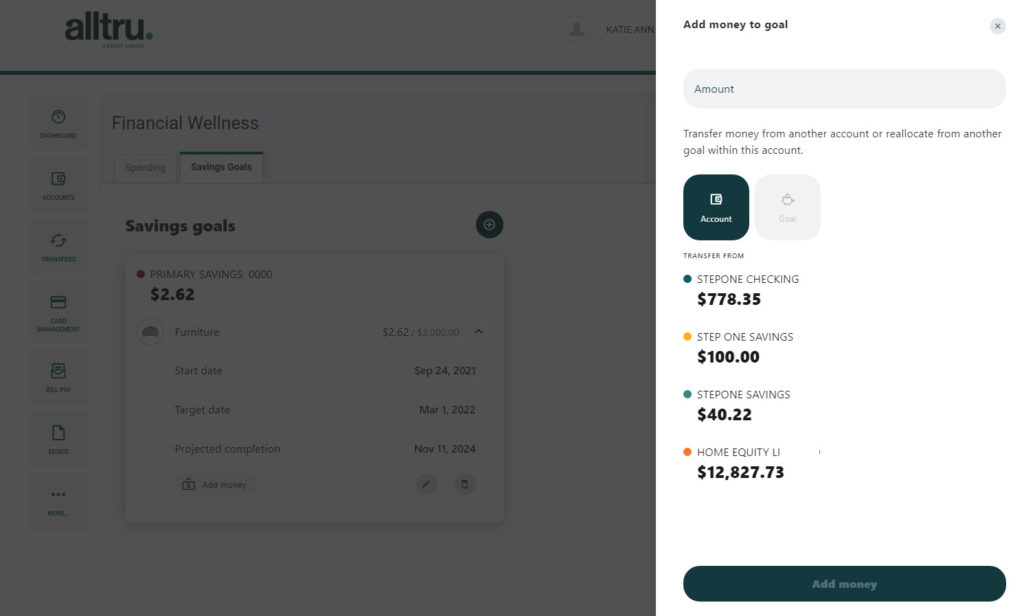

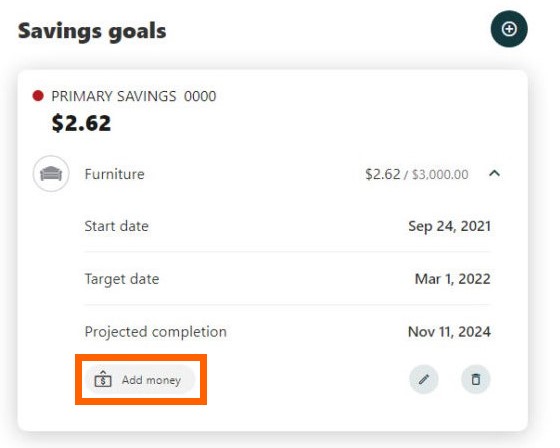

Your completed Savings Goal will look like this:

How to Add Funds to Your Savings Goal:

At this point you should have created your savings goal(s). To successfully save for your goal, you’ll need to allocate funds towards it. First, you can do this in 3 different ways:

- Deposit funds directly from the account linked to the savings goal.

- Transfer funds from a different account to the account linked to the goal.

- Reallocate funds from a different goal.

To choose any of these options, click on the Add Money button at the bottom of your savings goal.

Now that your goal is all set, happy saving! You can manage your goals and track their progress via online banking or by using the Alltru CU App.