Most people plan to save for – or want to save for – retirement. But research shows that many, including those approaching retirement age, do not have enough savings set aside for retirement.

When it comes to retirement, it can seem difficult to know where to start and what options are available to you. Let’s explore why it’s important to save for retirement, review different savings options, and dive into other important considerations.

Retire in comfort.

It’s tempting to let other things take priority over retirement, especially when it feels like it’s decades away. When you’re young, it’s easy to have a mindset in which retirement seems unimportant and is put on the back burner as a result. You’re not alone. But when you retire, the last thing that you want on your mind is financial insecurity and the possibility of running out of money. You’ve worked your entire life to get to that point, so you need to set aside enough funds to live comfortably in retirement. Also, you may have big goals on your mind like relocating or traveling, which come with a price tag. Keep reading to learn how to begin saving for retirement.

Depending on your retirement goals, a good rule is to save a minimum of 70% – 80% of your pre-retirement income.

We encourage you to utilize our online savings calculator to estimate your individual savings goal. Once you have an amount in mind, you’ll need to choose your type of retirement account. Alltru offers a Roth IRA and Traditional IRA so that you can decide which works best for your lifestyle.

Set up employer-sponsored contribution (401k) at your place of work.

Most employers offer to match your retirement contribution, which you should definitely take advantage of if you aren’t already. This is essentially free money coming straight from your employer, making it one of the smartest ways to save for retirement. We recommend setting up automatic contributions that are deducted from your paycheck and deposited straight into your retirement savings. This creates a good savings habit because you won’t have to think about it and manually contribute towards your retirement fund after each paycheck. Ask your benefits or HR representative if you’re unsure whether or not your employer offers a contribution plan and learn more about the options that are available to you.

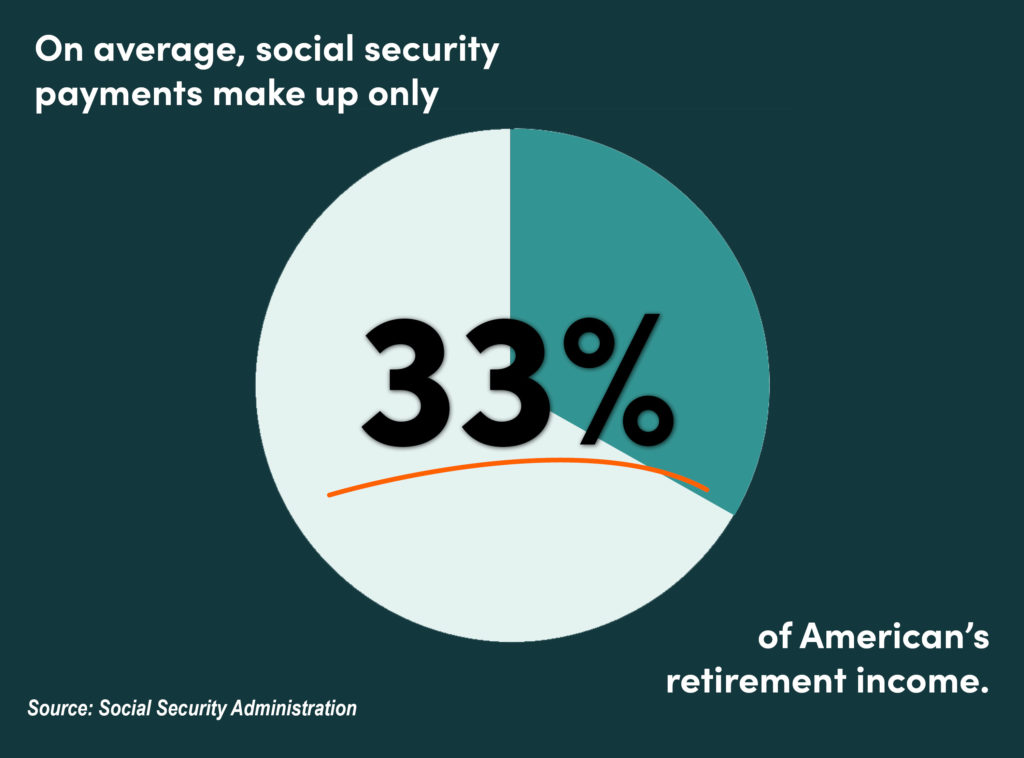

Don’t rely only on Social Security.

Why not? Most of the time Social Security doesn’t provide enough to adequately cover all of your retirement expenses, so don’t rely on it as your one and only resource. It’s designed to supplement retirement income, not replace it. According to the U.S. Census Bureau, today’s retiree gets less than half of their income from Social Security – the rest will need to come from your retirement savings.

Increase your contributions incrementally as you get older.

Although retirement may be the last thing on your mind, it’s very important to start saving at a young age. Even if it’s not a large amount at first, the power of compounding interest will make a huge difference when you do retire. As you get older and your salary continues to increase, your retirement contributions should increase too. This way, you’ll be on the right path to financial success and a comfortable retirement. Bottom line: The earlier you start to save, the more likely you are to achieve your retirement goals.

Consider investing your money.

Investing can sound scary at first, and most people find it intimidating. That’s completely normal. When you invest money for retirement, that money can potentially earn returns. This means you may end up with more in your retirement fund than if you had simply set the money aside in cash or in a traditional savings account. Learning how to invest the right way can end up making you a considerable amount in savings. You can build a portfolio as conservative, moderate, or as aggressive as you want. As a beginner, plan on starting out with a conservative, risk-aversive portfolio. We strongly encourage you to talk to an investment advisor or a financial planner for professional guidance that will align with your individual goals for saving for retirement.