The smart money account for kids.

There’s a special feeling that comes when your kids can set and achieve their own savings goals. Alltru is here to help you make these dreams come true. Our TruSpend Savings account makes it easy for your kids, tweens, and teens to learn how to manage their money under your safety and guidance, for free.

Emma

Alltru Member

Audrey + Colton

Alltru Members

Alltru TruSpend Savings Account

APY*

*View full rate information and qualifiers.

Alltru TruSpend Savings Account Features

Empower your kid to learn about money.

Parental controls

Stay on top of your child’s spending with custom parental controls and take advantage of teachable money moments.

For kids and teens only

Kids, tweens, and teens are welcome. This checking account is for kids ages 8+.

Easy set up and no minimums

Set up the account for $1 and enjoy no monthly fees and no minimum balance requirements.

Manage money from anywhere

Our mobile banking app and account management tools make it easy.

Online and Mobile Banking

Mobile check deposits.

Deposit checks at anytime, from anywhere by snapping an image of your check with a smartphone.

Convenient debit card controls.

Lock, unlock, and re-order your debit card using the Alltru app.

Account notifications.

Get notified when a card has reached a limit, suspicious account activity, and more.

Security, guaranteed.

Your safety is our top priority. We provide the highest levels of security, encryption, and firewalls.

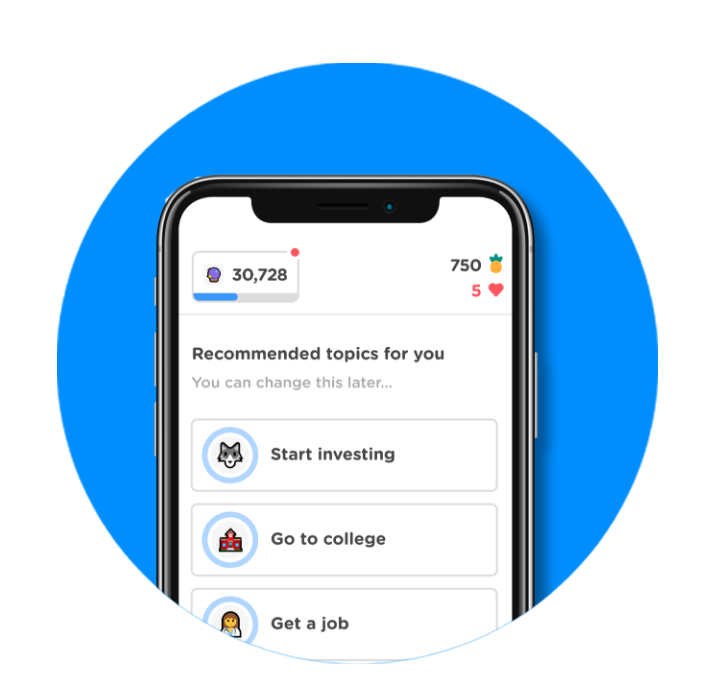

Alltru Credit Union + Zogo Gaming

Learn Financial Literacy from Anywhere.

How it works

Zogo is a gamified app that rewards users for completing financial literacy lessons. The app features 21 categories with more than 380 short, bite-sized financial literacy lessons.

- Download the Zogo App

- Level up your financial skills by completing bite-sized lessons

- Collect pineapples and redeem for gift cards to retailers like Amazon, Apple, Nike, Walmart, Starbucks, and more

- Plus, compete in daily trivia to test your knowledge for bonus pineapple opportunities

Enter Access Code:

ALLTRUCU

TruSpend Checking + Savings: Where money skills begin.

Pair a TruSpend Savings account with TruSpend Checking to help them learn how to save and spend wisely. Every TruSpend Checking includes a free debit card, making it easy for teens to shop responsibly, whether they’re at home or on the go. And when they turn 18, they can transition to a Basic Checking account to fit their growing needs.

For a limited time, members can receive $50 when opening a new TruSpend Checking account.

Let’s Talk

We’re in your neighborhood.

We are St. Louis, through and through. We have branches throughout the metro area. Plus, as a member you’ll have free access to hundreds of local ATMs.